Comprehensive Review: How the Republican Tax Plan Could Deepen the U.S. Deficit Crisis

Projected Surge in National Debt from Republican Tax Proposal

According to a recent report by the Congressional Joint Committee on Taxation (JCT), the Republican tax reform currently under discussion is anticipated to inflate the federal deficit by an estimated $3.7 trillion over the next ten years. This substantial increase has alarmed fiscal watchdogs and economic experts who caution that such a deficit expansion threatens the nation’s long-term financial health. Central to this fiscal impact are the bill’s major provisions,including meaningful cuts to corporate tax rates and broad reductions in individual income taxes.

Opponents of the bill highlight several critical risks associated with this growing debt, such as:

- Escalating government borrowing costs that could strain public finances

- Potential reductions in funding for vital social welfare and public services

- Increased inflationary pressures that may erode consumer purchasing power

- Possible downgrades to the U.S.sovereign credit rating, raising future financing expenses

Proponents maintain that the tax cuts will spur economic expansion robust enough to partially counterbalance the deficit increase, though this optimistic outlook remains debated among economists.

| Fiscal Category | Estimated Deficit Increase (Trillions) |

|---|---|

| Corporate Tax Reductions | $2.1 |

| Individual Tax Cuts | $1.3 |

| Additional Provisions | $0.3 |

Detailed Fiscal Breakdown from the Joint Committee on Taxation

The JCT’s in-depth fiscal analysis reveals that the lion’s share of the projected $3.7 trillion deficit increase stems from sweeping tax rate reductions. Notably, the corporate tax rate is slated to drop from 35% to 20%, accounting for nearly half of the revenue shortfall. Individual tax brackets are consolidated, resulting in lower overall tax collections, while the elimination of certain deductions intended to offset revenue losses falls short of expectations.

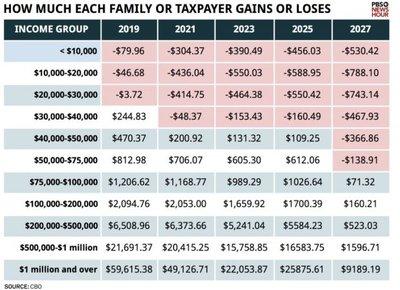

Without accompanying measures to curb spending or enhance revenues,these changes could exacerbate the nation’s fiscal imbalance. The report underscores the disproportionate benefits accruing to higher-income earners,raising concerns about equity and long-term sustainability.

| Category | Revenue Impact Over 10 Years |

|---|---|

| Corporate Tax Cuts | −$1.8 trillion |

| Individual Tax Adjustments | −$1.2 trillion |

| Deduction Eliminations | −$0.4 trillion |

| Other Provisions | −$0.3 trillion |

Economic Risks and Debt Burden: Expert Perspectives

Leading economists and fiscal analysts warn that the proposed tax legislation could substantially worsen the United States’ already substantial debt challenges. The JCT’s forecast of a $3.7 trillion deficit increase over the next decade raises serious concerns about the government’s capacity to maintain essential programs and manage borrowing costs effectively.

Key economic risks identified include:

- Rising Interest Rates: Increased federal borrowing may drive up interest rates,potentially crowding out private sector investment and slowing economic growth.

- Inflationary Pressures: Larger deficits could contribute to inflation, diminishing household purchasing power and increasing living costs.

- Credit Rating Vulnerabilities: A growing debt load heightens the risk of credit rating downgrades, which would elevate the cost of government borrowing and strain public finances further.

| Impact Category | Projected Effect |

|---|---|

| Deficit Increase | + $3.7 trillion (10 years) |

| Debt-to-GDP Ratio | Increase by approximately 15% |

| Interest Rate Rise | Estimated +0.5% by 2030 |

Policy Recommendations to Address Growing Fiscal Challenges

To counteract the projected deficit escalation, policymakers must adopt a balanced approach that combines prudent revenue reforms with disciplined spending controls. Implementing targeted tax base broadening—such as closing loopholes and limiting exemptions—without substantially raising rates could generate vital additional revenue.

Moreover, strategic investments in high-growth sectors like infrastructure, renewable energy, and technology innovation can foster economic expansion, thereby increasing future tax receipts and helping to offset deficit pressures.

On the expenditure side, a thorough reassessment of entitlement programs and discretionary spending is essential. Potential measures include:

- Gradual reforms to Social Security and Medicare eligibility criteria or benefit structures

- Elimination of redundant or inefficient government programs

- Enhanced clarity and accountability in federal budget allocations

Effective bipartisan collaboration will be critical to crafting sustainable fiscal policies that safeguard economic recovery while protecting vulnerable populations.

Summary: Navigating the Fiscal Future Amidst Tax Reform Debates

The Joint Committee on Taxation’s recent evaluation highlights the profound fiscal consequences of the Republican tax bill, forecasting a $3.7 trillion increase in the national deficit over the next decade. As legislative discussions continue, the long-term economic ramifications remain a focal point for policymakers, economists, and the public alike. The decisions made in the coming months will play a pivotal role in shaping the nation’s financial trajectory and economic resilience.