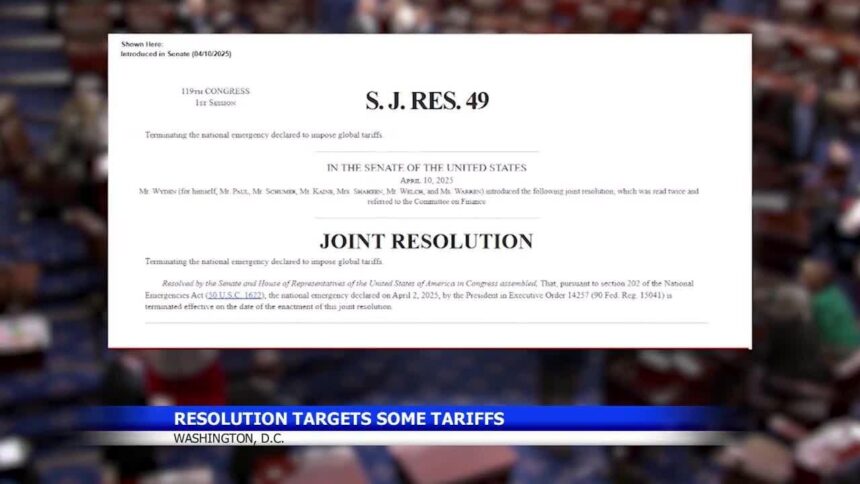

Senate Rejects Effort to Dismantle Trump-Era “Liberation Day” Tariffs Amid GOP Divisions

In a recent Senate vote, lawmakers declined to pass a resolution aimed at eliminating the contentious tariffs known as the “Liberation Day” tariffs, originally enacted during former President Donald Trump’s tenure. Although the proposal unexpectedly garnered support from a faction of Republican senators advocating for a shift in trade policy to reduce costs for American businesses and consumers, it ultimately failed to achieve the majority needed for approval. Opponents defended the tariffs as vital tools for safeguarding U.S. manufacturing sectors and maintaining strategic leverage in global trade negotiations.

Senate Vote Highlights Deep Partisan and Ideological Divides on Trade

The Senate’s narrow rejection of the repeal resolution—48 votes in favor versus 52 against—reflects the ongoing rift within the Republican Party and between the two major parties over the future of U.S. trade policy. Proponents of repeal argued that the tariffs have inflated production expenses and consumer prices, undermining American competitiveness in international markets. Conversely, defenders emphasized the tariffs’ role in reinforcing domestic supply chains and countering unfair foreign trade practices.

- Supporters of repeal: Pointed to rising costs for manufacturers and consumers, urging a recalibration of trade policies to enhance economic growth.

- Opponents of repeal: Highlighted the tariffs’ effectiveness in protecting key industries and preserving bargaining power in trade talks.

- Economic experts: Cautioned that an abrupt removal could destabilize markets and disrupt supply chains.

| Senate Vote Summary | Count |

|---|---|

| Votes Supporting Repeal | 48 |

| Votes Opposing Repeal | 52 |

Economic Consequences of Maintaining Tariffs on Select Imports

The persistence of the “Liberation Day” tariffs continues to fuel debate over their broader economic ramifications. Advocates argue these tariffs shield American industries from unfair competition, yet critics warn they contribute to higher production costs and inflationary pressures. Importers face increased expenses that often translate into elevated prices for consumers, potentially curbing purchasing power and slowing economic momentum. This creates a paradox where protective measures may inadvertently stifle the sectors they intend to support.

Recent data illustrates a nuanced impact on key economic indicators:

| Economic Indicator | Current Effect | Projected Trend |

|---|---|---|

| Consumer Price Index (Tariff-Affected Goods) | Approximately 5% increase | Moderate upward trend if tariffs persist |

| Domestic Manufacturing Output | Varied outcomes; some sectors gain, others lose ground | Potential stabilization with continued tariff enforcement |

| Trade Deficit | Marginal improvement observed | Uncertain, contingent on retaliatory measures abroad |

Economists emphasize several concerns:

- Escalation of trade conflicts that could restrict export markets.

- Heightened vulnerability of supply chains amid global economic fluctuations.

- Balancing immediate industry protection with sustainable long-term competitiveness.

Understanding the Bipartisan Rift on Tariff Policy and Trade Strategy

The Senate’s split vote reveals deep-seated disagreements across party lines regarding the “Liberation Day” tariffs. Within the Republican caucus, tensions exist between factions favoring protectionist policies and those advocating for freer trade principles. Democrats generally support a more diplomatic approach to trade that aims to protect American workers while avoiding unnecessary escalation of international tensions.

- Economic Impact Debate: Disagreement over whether tariffs ultimately benefit or harm U.S. manufacturing and consumer costs.

- Geopolitical Considerations: Tariffs as a tool for negotiation risk alienating key allies and complicating diplomatic relations.

- Political Calculations: Some GOP senators worry that repealing tariffs could alienate business supporters and voters in industrial states.

| Party Affiliation | Votes for Repeal | Votes Against Repeal | Absent/Not Voting |

|---|---|---|---|

| Republicans | 14 | 30 | 1 |

| Democrats | 3 | 47 | 2 |

| Independents | 1 | 1 | 0 |

This voting pattern highlights a GOP minority willing to move away from Trump’s trade legacy, contrasted with a broader consensus recognizing the tariffs’ ongoing political and economic significance. The lack of bipartisan agreement complicates efforts to establish a coherent and forward-looking U.S. trade policy amid global economic uncertainties.

Policy Recommendations to Address Tariff Effects on Domestic Markets

To alleviate the negative consequences associated with tariffs like the “Liberation Day” duties, policymakers should focus on enhancing transparency and flexibility in trade policy. Instituting mandatory periodic reviews would equip Congress with timely data on tariff impacts, enabling informed decisions and swift adjustments. Engaging with trade specialists, industry stakeholders, and consumer groups can foster balanced policies that protect domestic interests without compromising global competitiveness.

- Introduce sunset provisions requiring automatic reassessment of tariffs after a set period.

- Create a bipartisan oversight committee dedicated to monitoring tariff outcomes and advising on policy adjustments.

- Develop targeted support programs for domestic businesses disproportionately affected by increased import costs.

- Promote diversification of supply chains to enhance resilience against future disruptions.

| Policy Initiative | Expected Benefit |

|---|---|

| Regular Tariff Evaluations | Enables timely mitigation of economic stress |

| Bipartisan Monitoring Body | Ensures balanced and inclusive policy-making |

| Industry Relief Measures | Reduces job losses and supports economic stability |

| Supply Chain Diversification | Strengthens economic resilience to shocks |

Conclusion: Navigating the Complex Landscape of U.S. Tariff Policy

The Senate’s rejection of the resolution to repeal the “Liberation Day” tariffs underscores persistent divisions within Congress over trade strategy and the enduring influence of Trump-era economic policies. Despite some Republican support for repeal, the measure fell short, reflecting the intricate balance between political ideology, economic interests, and international trade dynamics shaping Washington’s approach to tariff regulation. As debates continue, the challenge remains to forge a unified, pragmatic trade policy that supports American industries while adapting to the evolving global economic environment.