The Senate has released a comprehensive blueprint detailing former President Donald Trump’s proposals on tax reform and Medicaid policy.The document outlines key legislative priorities aimed at reshaping the nation’s fiscal landscape and healthcare system. As lawmakers and analysts dissect the implications, the blueprint offers insight into the administration’s strategic direction on taxation and Medicaid funding, setting the stage for heated policy debates in the months ahead.

Senate Unveils Comprehensive Trump Tax Reform Plan

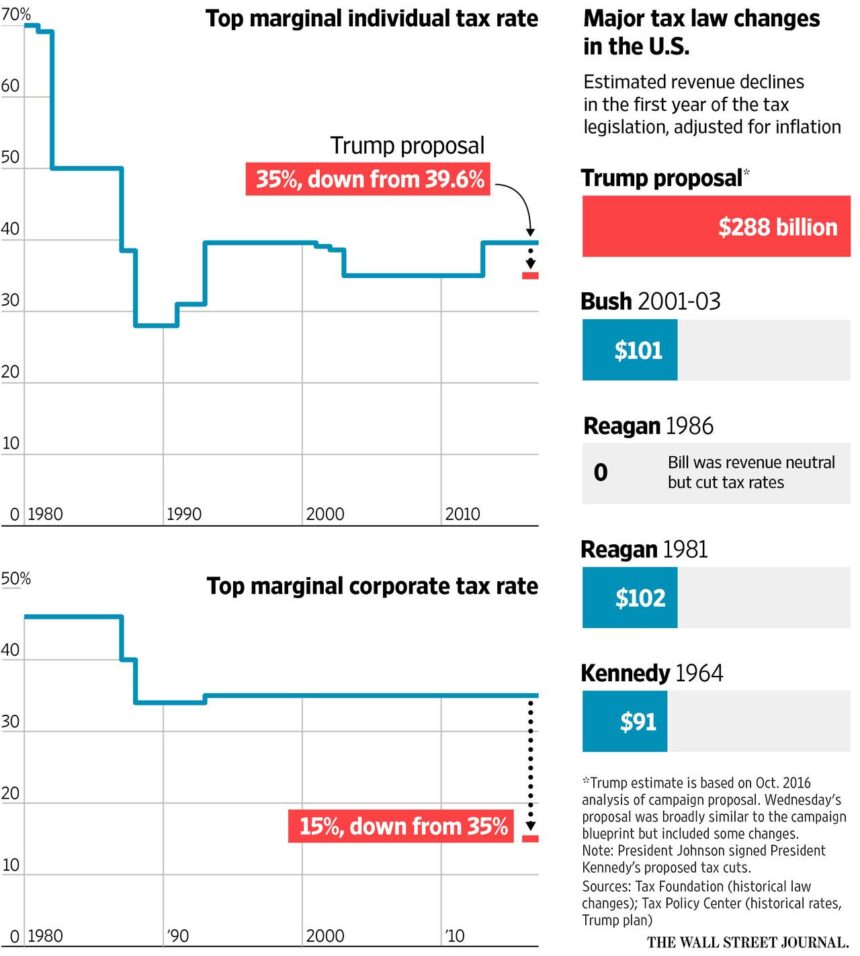

The Senate has introduced a sweeping legislative package aimed at overhauling key aspects of the federal tax system alongside significant changes to Medicaid. The blueprint prioritizes reducing the corporate tax rate,introducing stricter compliance measures,and revising individual tax brackets to reflect current economic realities. Lawmakers argue these moves will foster economic growth while ensuring a fairer tax landscape, especially targeting loopholes that disproportionately benefit high earners.

Highlights of the proposal include:

- Corporate tax rate cut from 28% to 21%

- New deductions for small businesses investing in technology

- Medicaid expansion reforms to enhance coverage in rural areas

- Increased funding for state-level healthcare initiatives

| Measure | Projected Impact | Timeline |

|---|---|---|

| Corporate Tax Reduction | Boost GDP by 1.5% | Effective FY 2025 |

| Tech Investment Deductions | Increase small biz growth | Immediate |

| Medicaid Rural Expansion | Cover 500,000 additional beneficiaries | Within 2 years |

Blueprint Details Medicaid Changes and Funding Strategies

The blueprint introduces significant modifications aimed at curbing Medicaid spending while promoting increased state control over funds. Key proposals include transitioning Medicaid to a block grant system, which would allocate fixed sums to states rather than matching federal funding based on actual expenditures. Proponents argue this change could lead to more efficient programme management, but critics caution it risks reducing coverage for vulnerable populations. Additionally, the plan introduces stricter eligibility requirements, possibly limiting access for certain groups.

Funding strategies detailed in the blueprint emphasize reducing federal outlays through a combination of cost-sharing adjustments and enhanced oversight mechanisms. Notable elements include:

- Caps on annual growth rates of federal Medicaid spending to enforce fiscal discipline

- Incentives for states that demonstrate improved healthcare outcomes and cost-effectiveness

- Implementation of block grants to encourage innovation at the state level

| Provision | Proposal Impact | Estimated Savings |

|---|---|---|

| Block Grants | Fixed funding to states | $150 billion over 10 years |

| Eligibility Tightening | Reduced enrollment | $45 billion over 10 years |

| Cost-sharing Adjustments | Higher out-of-pocket costs | $30 billion over 10 years |

Experts Weigh In on Economic and Social Impacts

Economists and social policy experts offer varying interpretations of the Senate’s newly unveiled plan, highlighting deep concerns about its potential ripple effects. Some analysts emphasize that the blueprint could accelerate economic growth by reducing corporate tax rates and simplifying regulations, arguing it may create a more competitive environment domestically and abroad. However, critics warn that the reduction in Medicaid funding might disproportionately affect lower-income populations, potentially eroding essential health services and widening socioeconomic disparities.

Key points highlighted by experts include:

- Economic Growth: Forecasts suggest a modest uptick in GDP driven by increased investment and consumer spending among higher-earning brackets.

- Healthcare Access: Potential decline in Medicaid coverage rates, with long-term implications for public health metrics.

- Income Inequality: Concerns about the blueprint exacerbating wealth gaps given proposed tax cuts largely favoring the affluent.

- Fiscal Impact: Debates continue on whether anticipated revenue losses can be offset by economic expansion alone.

| Impact Area | Positive Effects | Negative Effects |

|---|---|---|

| Economic Growth | Increased investment | Short-term market volatility |

| Healthcare | Streamlined Medicaid administration | Reduced coverage for vulnerable groups |

| Social Equity | Potential job creation | Widening income disparities |

Policy Recommendations Aim to Balance Growth and Equity

To navigate the complexities of economic expansion alongside social responsibility, lawmakers have put forward several strategic proposals. These measures endeavor to stimulate business investment and job creation while safeguarding vulnerable populations from potential fiscal strain. Emphasizing targeted tax credits and Medicaid eligibility adjustments, the blueprint aims to ensure that growth does not come at the expense of equity.

Key policy actions include:

- Implementing incremental tax relief for small and medium enterprises to boost local economies.

- Expanding Medicaid thresholds to cover more low-income families without significant budgetary increases.

- Incentivizing renewable energy adoption through tax deductions, promoting sustainability and economic resilience.

- Establishing a framework for periodic reviews to adapt policies based on measurable outcomes in both growth and equity.

| Policy Area | Projected Impact | Timeline |

|---|---|---|

| Tax Credits | Increase small business investments by 15% | 2024-2026 |

| Medicaid Expansion | Reduce uninsured rate by 10% | 2024-2025 |

| Renewable Incentives | Cut emissions 8% by 2026 | 2024-2028 |

In Conclusion

The Senate’s release of the Trump tax and Medicaid blueprint marks a significant advancement in the ongoing policy debate, offering a detailed framework that could reshape fiscal priorities and healthcare funding.As lawmakers and stakeholders review the proposals, the coming weeks are expected to see intense discussions on the potential impacts and feasibility of implementing these plans. The blueprint provides a clear outline of priorities for the administration’s agenda, though its ultimate effect will depend on legislative negotiations and bipartisan support moving forward.